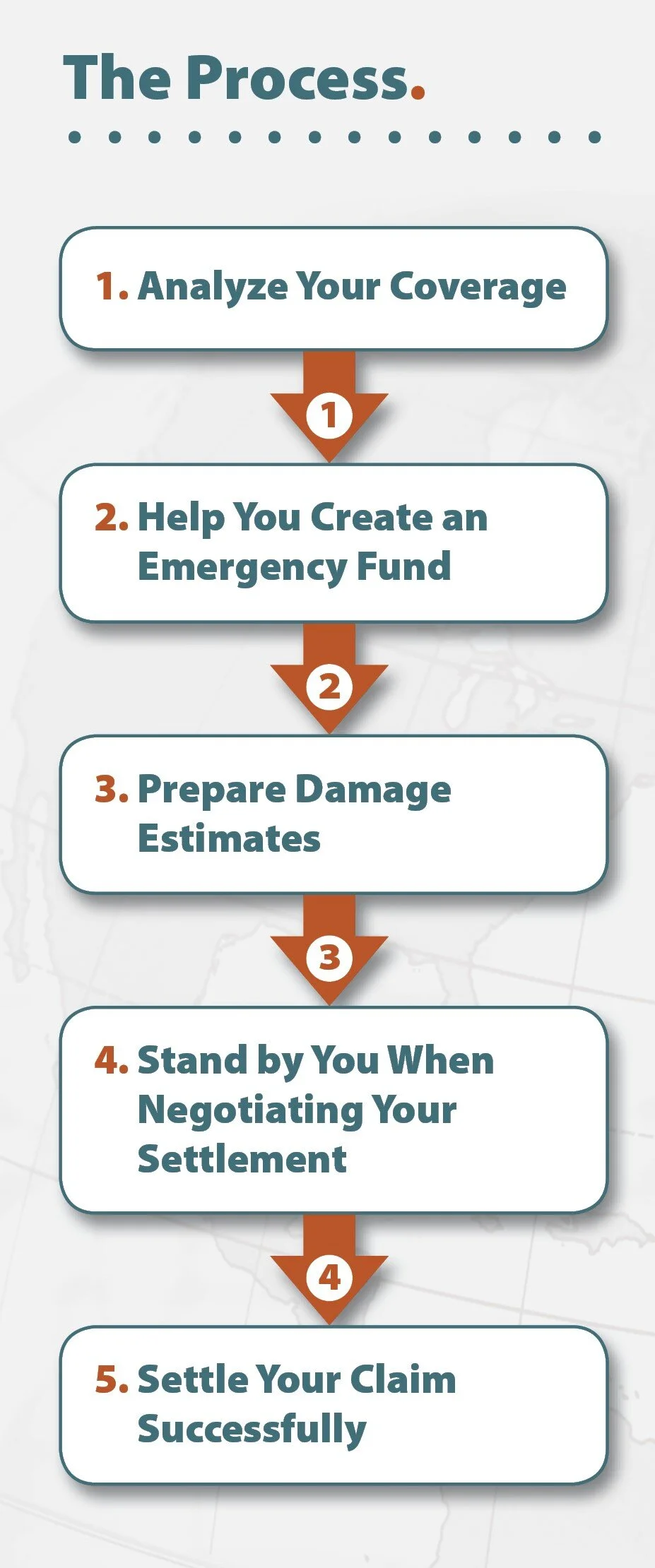

Claims Management Process

1. Analyze Your Coverage

Review the provisions and exclusions of your policy.

Explain how we analyzed your policy so that you understand how it relates to your loss.

Assist you in understanding the requirements of your policy.

Help you maximize your financial recovery by developing a proactive personalized strategy to handle your claim.

2. ASSIST WITH YOUR IMMEDIATE NEEDS

Request that the insurance company release an advance of funds.

Organize and prepare a complete list of additional living expenses (for the homeowner) and work with you and your insurance company in order to get reimbursed for them.

Organize and prepare a business continuity plan (for the business owner) and work with you and your insurance company to facilitate continued operations in a timely manner.

Help you find temporary accommodations for your family or business if your loss causes you to relocate.

3. Prepare a Damage Estimate

Provide a detailed review of all damage to your property, documenting damage to all areas.

Provide line item estimates, calculate quantities, unit cost and total costs to cover your loss.

Prepare and submit all of the above to the insurance company using industry-standard forms; thereby, enhancing a prompt and accurate response to your claim.

4. Stand by You While Negotiating Your Settlement

Attend all meetings with adjuster(s) so that you can get back to your normal schedule.

Report details and action items of each meeting on a regular basis.

Communicate all settlement offers to you and recommend whether to accept them or negotiate further.

Manage any insurance claim problems or challenges.

Accept settlement offers only after your review and consent.

5. Settle Your Claim Successfully

Obtain all that is rightfully due to you from the insurance company.

Resolve claims as quickly as possible.

Help return you to your normal lifestyle or get you back to business as usual.